What do the 1600s and Josh have in common?

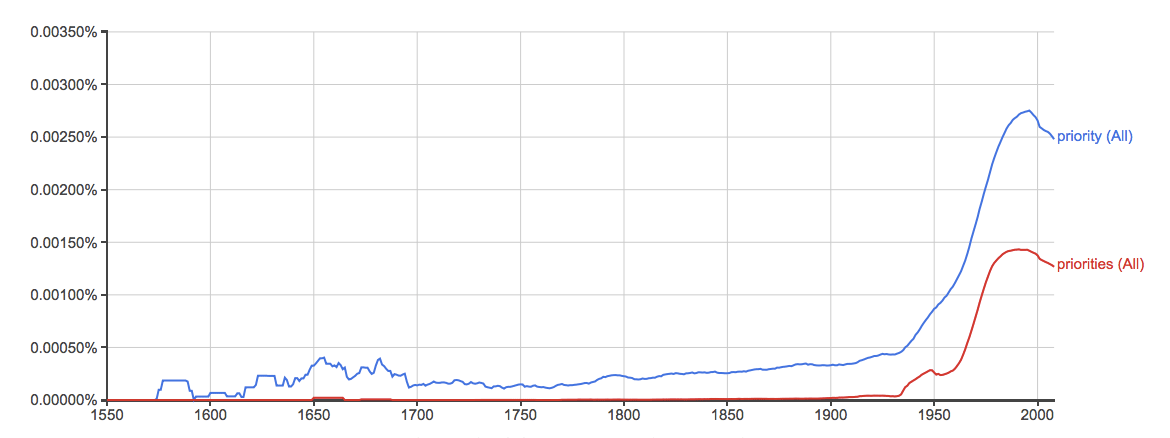

Have you ever thought about the words priority and priorities? I never had until this week when a guy at work, Nate, shared this interesting chart:

You see, according to Google Books, the word Priority started picking up use just before the 1600s, while the word Priorities didn’t really creep up until the 1930s. That’s over 300 years of single-focus Priority before we muddied up the idea by pluralizing it!

Imagine for a moment being in the 1600s without the concept of multiple “priorities”. Set aside the fact that your clothes are itchy, your life is generally much less convenient, and you likely have no money…wouldn’t it be nice to pick just one thing at a time to focus on?

Well, here’s the good news, you don’t have to go back in time to forget about priorities—you can go old school with your finances today…even in your comfy clothes! :)

Last week I shared some advice I gave to one of my internet friends, a guy named Josh. The core of my advice to Josh was to stop trying to do so much and instead just focus on one thing at a time—I wanted him to choose a priority!

Josh took it to heart, and he prioritized!

In case you don’t recall the details from last week…Josh and his wife were doing pretty good things with their money.

- They had their home on a 15-yr mortgage

- They were doing great with their 401k

- They had a plan to pay off their student loans over the course of a little over a year

- And they were paying extra toward their mortgage each month so they could pay it off 3 years early!

These two weren’t really making any “bad” decisions with their money, they just weren’t making enough decisions about what their Priority was. Working on multiple “priorities” was overwhelming, discouraging, and ultimately had Josh saying that he’d hit the end of his rope with budgeting.

Within a month or two of our conversation, Josh and his wife had doubled down on a priority and made incredible progress—I mean it, you’re gonna be impressed!

Here’s what they did

“Our first goal was to pay off my student loans.”

First they identified what their Priority was. Note that it’s just one thing, getting rid of that student loan.

Next, they started looking at each of the “priorities” they had been working on before, and found a way to them out of the way.

“We realized putting extra money toward the mortgage was preventing us from paying off our debt. So, we moved that monthly $240 to our debt snowball category.”

First up was the extra money they were paying toward their mortgage. By removing that 2nd-tier “priority” in favor of the real priority, they had an extra $240 to throw at the student loan, and the change was hardly going to affect mortgage timeline.

Next, Josh and his wife evaluated the auto loan they had on an SUV, and what it’s impact was on slowing their real priority, here’s what they did with that:

“We looked at how much we were paying for the [car] loan, its payment schedule, and the amount we were paying toward gasoline for that SUV. We realized it would be in our best interest to sell the SUV and buy a cheaper (but equally safe) sedan with cash.”

Josh got a deal on a used Corolla, giving them even more cash to put towards the debt each month. It’s with this car that you start to really see Josh and his wife taking the priority they’ve set seriously, check this out:

“We still had to use a couple thousand dollars of our emergency fund to buy [the Corolla] outright. Again, we saw this as worth it so as to avoid debt and move the money we were spending monthly on our car loan toward the debt snowball.”

Not only did these two make the sacrifice of swapping out their nice SUV for a used car, but they did it by pulling from their cash reserves. Now that’s commitment, sacrifice, and prioritizing!

Fortunately some convenient timing made their next show of commitment a bit easier on them:

“I started a new job in October, and my 401k hasn’t kicked in yet. So, until the 401k does kick in, we moved the amount of money I would have been putting into my 401k to our debt snowball.”

As you can imagine, between holding off on extra payments on the house, getting rid of their car payment, and using the money they’d usually contribute towards a 401k, these two had scraped together a nice big monthly payment. After they’d made the changes they actually sat down one night to calculate how long it’d take to pay off their student loan. Amazingly, they’d created a monthly payment big enough to reduce their payoff date from 1 year all the way down to 3 months!

But with their singular priority in mind, that wasn’t enough, they wanted this so badly they were willing to get even more creative.

“Instead [of paying the loan off over 3 months], we decided to use some of our emergency fund savings to pay off my student loans that very night.”

When I heard this part from Josh I could hardly believe it! These two completely leveled their entire student loan in a single night—all it took was a decision to prioritize what mattered most to them!

Early house payoff? Not the priority—we can slow that down by one year. Car loan? Not the priority—they got rid of it. Retirement savings? Not the priority—it can wait a few months.

Student loan? That’s the priority—paid off a year’s worth of payments in 1 night!

Wow, that must have felt amazing! Do you want a taste of that kind of success?

What’s Next?

Now that Josh and his wife have zeroed in and completely nailed their priority, what’s next? Well, they’ve chosen a new priority:

“Going forward, we’ll use the [money we were using toward debt] each month to pay back our emergency fund.”

I suspect they’ll be done with this priority in just a few months, and then they’ll choose another one and knock it out of the park too. You see, these two are on a roll now, and they’re going to keep on rolling!

The power of priority is doing for Josh and his wife what it’s done for Katie and I—it’s accelerating their success rate at whatever it is they care the most about.

How about you?

- What’s your Priority?

- Have you been trying to do too much at once?

- Are your financial efforts being spread across too many fronts?

Here’s what you can do about it this weekend:

- Sit down with your loved one and share Josh’s story with them

- Figure out what your singular financial priority is—remember it’s not a priority if there’s more than one

- Analyze what other financial efforts are slowing down your progress towards your priority

- Pick one non-priority area to simplify or remove from your life—even if it’s just short-term

- Take the energy and resources you were putting towards that non-priority and focus it all on your real priority

- See how fast your dream comes true!

Happy Holidays!

-Conor

P.S. I’m going to take a break from writing the newsletter for awhile.